What Is the 10-Year Treasury Yield?

The 10-year Treasury yield is a benchmark interest rate reflecting investors’ expected return when buying a 10-year U.S. Treasury bond. It’s widely regarded as a barometer for the economy.

Basics of Treasury Bonds

Treasury bonds are long-term debt securities issued by the U.S. government to fund its operations. Investors receive regular interest payments and the principal amount upon maturity.

Why the 10-Year Yield Matters

The 10-year yield serves as a benchmark for various financial instruments, influencing everything from mortgage rates to corporate debt costs. It’s also a crucial indicator of investor sentiment about the economy.

How Is the 10-Year Yield Calculated?

Relationship Between Price and Yield

The yield is inversely related to the bond’s price. When demand for 10-year Treasury bonds rises, prices increase, and the yield decreases, and vice versa.

Role of the Federal Reserve

The Federal Reserve indirectly impacts yields through monetary policy decisions, such as setting the federal funds rate and implementing quantitative easing programs.

The Importance of the 10-Year Treasury Yield

Economic Indicator

Reflecting Investor Confidence

High yields often indicate a growing economy and investor confidence, while low yields can signal economic uncertainty.

Correlation with Economic Growth

The yield often moves in tandem with economic cycles, making it a reliable indicator of potential booms or recessions.

Benchmark for Interest Rates

Mortgage and Loan Rates

Lenders use the 10-year yield to determine mortgage and loan rates. A rise in the yield often leads to higher borrowing costs.

Corporate Borrowing Costs

Corporations look at the 10-year yield when issuing bonds, as it directly influences the interest they must pay.

Factors Influencing the 10-Year Treasury Yield

Monetary Policy

Federal Reserve Actions

When the Fed raises interest rates, the 10-year yield typically follows suit, as borrowing costs rise across the board.

Interest Rate Adjustments

The Fed’s stance on monetary tightening or easing has a significant impact on the yield’s movement.

Inflation

Impact on Real Yield

Higher inflation erodes the purchasing power of future interest payments, causing yields to rise.

Inflation Expectations

Anticipation of inflation affects investor decisions, directly influencing yields.

Supply and Demand Dynamics

Domestic Investors

Strong demand from domestic investors can suppress yields by driving up bond prices.

Foreign Investment Trends

Global investors, particularly central banks, significantly affect the yield by their appetite for U.S. Treasuries.

The Impact of 10-Year Treasury Yield on Markets

Stock Market Implications

Growth vs. Value Stocks

Rising yields often hurt growth stocks, which rely on future earnings, while value stocks may benefit from higher yields.

Sectoral Performance

Certain sectors, such as financials, perform better in a high-yield environment, while others, like technology, may suffer.

Bond Market Relationships

Inverse Relationship with Bond Prices

As yields rise, bond prices fall, impacting existing bondholders negatively.

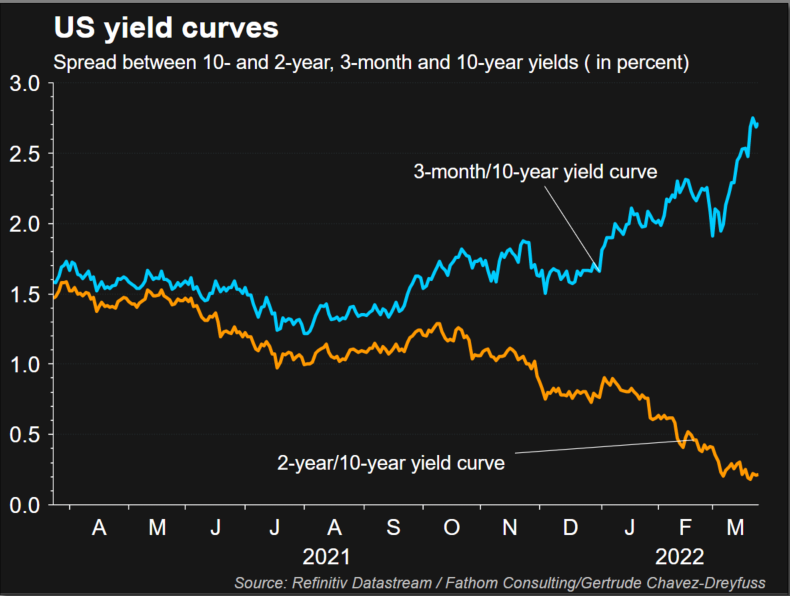

Yield Curve Dynamics

A steepening yield curve suggests economic growth, while an inverted curve often predicts a recession.

Historical Trends of the 10-Year Treasury Yield

Major Historical Highs and Lows

Economic Contexts Behind the Changes

From the high yields of the 1980s due to inflation to the lows during the 2020 pandemic, the yield reflects varying economic landscapes.

Lessons from Past Trends

Studying historical trends helps investors understand how external factors influence the yield over time.

How to Interpret the Current 10-Year Treasury Yield

Significance in Today’s Economy

The yield serves as a snapshot of investor expectations about economic growth, inflation, and interest rates.

Investment Strategies Based on the Yield

Investors can use yield trends to adjust their portfolios, balancing between equities, bonds, and alternative investments.

Conclusion

The 10-year Treasury yield isn’t just a number on a chart—it’s a window into the economy’s health and direction. By watching this yield, you can gain insights into market trends, interest rates, and economic cycles.